Stamp collecting, known as philately, has captivated enthusiasts for centuries. For advanced collectors, stamp albums become more than just storage— they are a cornerstone for showcasing rare and valuable stamps that can sometimes be appreciated significantly. But as with any investment, there are questions and concerns surrounding stamp albums for advanced collectors: the ultimate investment or a risky obsession? In this article, we will explore both the potential rewards and risks associated with collecting rare stamps and building a sophisticated album collection, helping you understand whether it is truly the ultimate investment or merely a dangerous obsession.

What Makes Stamp Albums for Advanced Collectors Different?

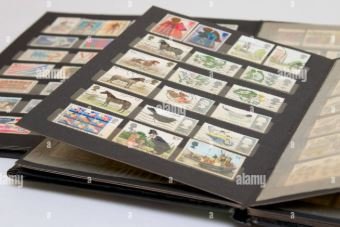

For novice collectors, the process of collecting stamps might start with simple albums, but for advanced collectors, the stakes are much higher. Stamp albums for advanced collectors are designed to house stamps that are not only rare but also have significant historical, cultural, or financial value. These albums are meticulously curated and organized to reflect the collector’s personal interest, geographic focus, or thematic preferences. The rarest stamps, often used as investment assets, can command astronomical prices, and for some, stamp albums for advanced collectors can represent a substantial financial portfolio.

However, this specialized approach to collecting requires deep knowledge, access to specialized markets, and substantial investment. The question then arises: are stamp albums for advanced collectors the ultimate investment, or is the obsession with building the perfect collection a risky pursuit?

The Investment Potential of Stamp Albums for Advanced Collectors

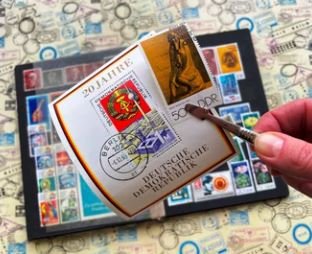

The allure of stamp albums for advanced collectors as an investment is undeniable. Over time, rare and limited-edition stamps have appreciated significantly, sometimes providing returns that far exceed those of traditional investment assets such as stocks and bonds. A famous example is the sale of the “British Guiana 1c Magenta,” which sold for a staggering $9.5 million in 2014. This iconic stamp is a prime example of why stamp albums for advanced collectors can be viewed as investments that unlock the potential for incredible financial rewards.

But why do stamp albums for advanced collectors hold such value? The answer lies in the rarity, condition, and historical significance of the stamps housed in these albums. Unlike most modern collectibles, which are often produced in large quantities, many of the stamps sought after by advanced collectors are limited in number. This scarcity, combined with the preservation of these stamps in mint or near-mint condition, drives up their demand among other collectors and investors.

Investing in stamp albums for advanced collectors can provide an alternative to traditional financial markets, where stocks and bonds are subject to volatile fluctuations. Rare stamps, on the other hand, can act as tangible assets that hold their value over time and are less susceptible to inflation or market crashes. For those who approach it with the right knowledge, stamp albums for advanced collectors can become an avenue to build wealth and create a diversified portfolio.

The Risks Involved: Stamp Albums for Advanced Collectors as a Risky Obsession

While the potential rewards of stamp albums for advanced collectors are significant, the risks involved should not be overlooked. Many people who invest in rare stamps do so because they are passionate about the hobby, but for some, the line between investment and obsession can blur. One of the biggest risks of building stamp albums for advanced collectors is the emotional attachment to the collection, which can lead collectors to make decisions that aren’t financially sound.

1. Market Volatility

Unlike other investment assets like real estate or stocks, the market for stamps can be highly volatile. Just because a stamp is rare doesn’t mean it will always maintain or increase in value. The market for rare stamps is subject to changing trends, economic conditions, and shifts in collector interest. For example, stamps that were once considered highly valuable might experience price declines if the demand for them decreases. Investing in stamp albums for advanced collectors may lead to financial losses if the collector is not aware of market fluctuations.

2. Counterfeits and Fakes

As with any collectible market, stamp albums for advanced collectors are not immune to the risk of counterfeit stamps. Forgeries can be highly sophisticated, and novice collectors may easily be misled. If a collector buys a forged stamp, they risk not only losing money but also damaging the integrity of their entire collection. Authenticity verification is critical in the world of rare stamps, and failure to ensure that stamps are genuine could render an entire collection worthless.

3. High Initial Investment and Maintenance Costs

Building a comprehensive collection of rare stamps is not cheap. The cost of acquiring high-quality stamps can be astronomical, and for stamp albums for advanced collectors, the expenses don’t stop at purchasing stamps. Proper care, storage, and insurance are essential to maintaining the collection’s value. Stamp albums for advanced collectors are often not just collections of stamps, but valuable assets that need to be kept in perfect condition. This requires specialized storage solutions, climate control, and sometimes professional conservation. These ongoing costs can add up quickly, making it a costly pursuit.

4. Liquidity Issues

While stamp albums for advanced collectors can be valuable, they are not always easy to liquidate. Unlike stocks or bonds, which can be quickly sold on financial markets, rare stamps require finding the right buyer, often through niche auctions or dealers. Selling a rare stamp can take time, and there’s no guarantee that you’ll recoup your original investment or make a profit. The lack of liquidity in the rare stamp market can make it a risky asset to rely on for short-term financial needs.

Is the Obsession with Stamp Albums for Advanced Collectors Worth It?

For many collectors, the joy of owning rare stamps and curating stamp albums for advanced collectors goes beyond financial gain. It’s about passion, history, and the satisfaction of owning something unique and valuable. However, when viewed strictly from an investment perspective, it’s essential to weigh the potential for financial growth against the risks associated with such a niche market.

For investors with a deep understanding of philately and a strong passion for the hobby, stamp albums for advanced collectors can be a rewarding long-term investment. But for those who enter the market without proper research, the obsession with acquiring rare stamps can quickly turn into a financial risk rather than a profitable venture.

How to Maximize the Investment Potential of Stamp Albums for Advanced Collectors

If you decide that stamp albums for advanced collectors might be the right investment for you, there are ways to maximize your chances of success:

- Educate Yourself: The more you understand about rare stamps and the philatelic market, the better equipped you will be to make smart investment decisions. Consider taking courses, attending stamp shows, or consulting with experts in the field.

- Focus on Rarity and Condition: The value of a stamp is directly tied to its rarity and condition. Only invest in stamps that are in mint or near-mint condition and are rare enough to warrant significant demand.

- Diversify Your Collection: Like any investment, diversification is key. Spread your investments across different periods, regions, and themes to reduce risk and improve your chances of seeing a return.

- Seek Expert Advice: Given the complexities of the stamp market, consulting with experts can help you make informed decisions and avoid costly mistakes.

Conclusion

The question of whether stamp albums for advanced collectors represent the ultimate investment or a risky obsession is not easily answered. While rare stamps can offer significant financial returns, they also come with their share of risks, including market volatility, counterfeit stamps, and liquidity issues. For those with a deep passion for the hobby and the knowledge to navigate the market, building stamp albums for advanced collectors can indeed be a rewarding and profitable endeavor. However, for those who approach it as a speculative investment without sufficient expertise, it can quickly turn into a risky obsession. As with any investment, it’s crucial to weigh the potential rewards against the risks and proceed with caution.