Stamp collecting has long been considered a captivating hobby, but in recent years, it has also emerged as a potentially lucrative investment opportunity. For those who are wondering how to invest in rare stamps, the question often boils down to balancing the promise of significant returns with the risks involved. While rare stamps can sometimes fetch astounding prices, the process of investing in them is not without its complexities. In this article, we will explore how to invest in rare stamps, examining both the potential rewards and the pitfalls investors should consider before diving into this niche market.

The Allure of Investing in Rare Stamps

When you think about how to invest in rare stamps, you might envision owning pieces of history, rare artifacts that have the potential to appreciate in value over time. Rare stamps, due to their scarcity and historical significance, can be highly sought after. A famous example is the “Inverted Jenny” stamp, a printing error from the United States that sold for over $1 million. Such rare stamps have been known to see their value increase dramatically, making them an attractive investment option for those with an interest in philately.

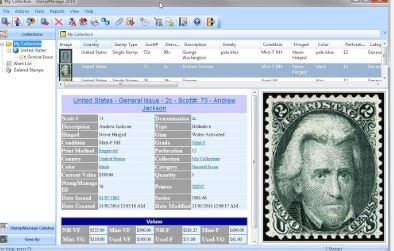

The investment potential of rare stamps lies in their rarity, demand, and condition. Rare stamps are usually produced in limited quantities, and some are even the result of printing errors or historical events, making them both valuable and collectible. How to invest in rare stamps involves identifying stamps with these characteristics and acquiring them with the hope that their value will continue to grow over time.

The Risks of Investing in Rare Stamps

As with any investment, how to invest in rare stamps comes with its risks. While rare stamps can deliver impressive returns, there is no guarantee that their value will continue to rise. Several factors can influence the market for rare stamps, including economic downturns, changes in collector interests, or the emergence of new, more attractive stamps.

One of the primary risks associated with how to invest in rare stamps is the potential for counterfeit stamps. The stamp market is susceptible to forgeries, and purchasing a fake stamp can lead to significant financial loss. Without proper knowledge or guidance, a collector may unwittingly buy a forged stamp that is indistinguishable from an authentic one. Therefore, ensuring that you are purchasing from reputable dealers and obtaining certificates of authenticity is essential.

Additionally, the rare stamp market can be highly volatile. While some rare stamps have increased in value dramatically, others may not see the same level of demand or appreciation. The stamp market is influenced by factors such as trends in the philatelic community and broader economic conditions, meaning that the value of a rare stamp can fluctuate unexpectedly.

How to Invest in Rare Stamps: A Step-by-Step Guide

For those interested in how to invest in rare stamps, understanding the process is essential to making informed decisions. Here’s a step-by-step guide to navigating the world of rare stamp investment:

- Educate Yourself: The first step in how to invest in rare stamps is education. Understanding the history of stamps, their designs, and their market value is crucial. Learn about the different categories of rare stamps, including limited editions, misprints, and those from important historical events. The more you know about stamps, the better equipped you’ll be to identify which ones are worth investing in.

- Research the Market: Before purchasing any rare stamps, research the current market trends. What are the most sought-after stamps? Which stamps are currently appreciating? This knowledge will give you an understanding of what types of stamps have the most investment potential. Follow auction results, read stamp-collecting magazines, and consult with experts in the field to get a feel for the market.

- Assess Stamp Condition: The condition of a stamp is a critical factor in determining its value. When learning how to invest in rare stamps, focus on acquiring stamps that are in mint condition or close to it. Stamps with creases, tears, or fading are generally less valuable than those that have been well-preserved. Always consider the grade of the stamp before making a purchase.

- Seek Expert Advice: As with any investment, consulting with experts is a wise decision. Philatelists, stamp dealers, and auction house specialists can provide valuable insight into the market and help you identify high-value stamps. If you are new to stamp investing, seek advice from a professional before making significant investments.

- Invest Wisely and Gradually: How to invest in rare stamps is also about balancing risk and reward. Begin with a small, diverse collection of stamps. This allows you to minimize the risk while gaining experience and a better understanding of the market. Avoid spending all your resources on one stamp, no matter how rare or enticing it may seem.

The Market for Rare Stamps: Understanding the Potential Returns

The potential for returns on rare stamp investments is one of the key reasons why people are drawn to how to invest in rare stamps. Some rare stamps have been appreciated by thousands or even millions of dollars over time. For example, the 1856 British Guiana 1c Magenta, one of the rarest stamps in the world, was sold for $9.5 million in 2014.

While the potential returns from how to invest in rare stamps are attractive, it is important to understand that the market for rare stamps is niche and can be volatile. There are times when demand for certain stamps wanes, and prices may fall. However, for investors who are patient and willing to take a long-term approach, rare stamps can be an excellent way to build wealth.

Many rare stamps also serve as a form of wealth preservation. Given the scarcity and uniqueness of these stamps, they can act as tangible assets that are less susceptible to market volatility compared to traditional investments like stocks or bonds. Over time, rare stamps may become more valuable due to their increasing scarcity or because they are seen as historical artifacts.

Is Investing in Rare Stamps Right for You?

The decision of how to invest in rare stamps ultimately depends on your financial goals, risk tolerance, and interests. If you have a passion for history, art, or collecting, investing in rare stamps can be both enjoyable and profitable. However, if you’re looking for a quick return on investment, you may want to reconsider, as the rare stamp market often requires a long-term commitment.

It’s important to approach stamp investing with caution and thorough research. While rare stamps offer the potential for lucrative returns, they also come with risks, including market volatility, counterfeit stamps, and a lack of liquidity. If you are serious about how to invest in rare stamps, it’s crucial to take a thoughtful and measured approach, ensuring that you understand both the rewards and the potential pitfalls.

Conclusion

How to invest in rare stamps is a question that has intrigued many, offering both the promise of significant rewards and the risk of financial loss. While rare stamps can indeed unlock lucrative potential, they require careful consideration, expertise, and patience. For those willing to put in the time and effort to understand the market, investing in rare stamps can be a rewarding and profitable venture. However, as with all investments, it’s crucial to weigh the potential rewards against the risks and to invest wisely.